For Canadian Small Business Only

Methods to withdraw RESP

Navigating the financial landscape of your child’s education expenses, especially with rising inflation, can be challenging. Whether you're already contributing to a Registered Education Savings Plan (RESP) or considering opening one to fund your child’s post-secondary education, it’s essential to understand the rules and benefits associated with RESP withdrawals.

Here’s a comprehensive guide to help you make the most of your RESP in Canada.

What is an RESP?

A Registered Education Savings Plan (RESP) is a long-term savings account designed to help parents and guardians save for a child’s post-secondary education. The funds can be used to pay for tuition, books, tools, transportation, and even rent.

As a "subscriber" (the person who opens the account), you can set up an RESP with a financial institution (known as a "promoter") for the following beneficiaries:

- Your own child

- Someone else’s child (e.g., a grandchild, niece, nephew, or friend’s child)

- Yourself or another eligible adult

There are three types of RESP plans available, depending on your situation. Let’s dive deeper into the benefits associated with RESPs.

Three Key Government Benefits of RESPs

There are three primary RESP benefits offered by the Canadian government:

1.Canada Learning Bond (CLB):

- The CLB provides financial assistance to children from low-income families. No contributions are required to access this benefit. The CLB offers $500 in the first year and $100 annually until the child turns 15, up to a lifetime maximum of $2,000. Eligible adults born in 2004 or later can receive the CLB until the age of 21.

2. Canada Education Savings Grant (CESG):

- The CESG matches 20% of your RESP contributions, up to $500 per year, for a lifetime maximum of $7,200 per child. Additional amounts of up to $100 per year are available for low- and middle-income families.

3.Provincial Benefits in British Columbia and Québec:

- In BC, the BC Training and Education Savings Grant (BCTESG) offers a one-time $1,200 grant for eligible beneficiaries.

- Québec provides the Québec Education Savings Incentive (QESI), a refundable tax credit of 10% of RESP contributions, up to $250 annually, with an additional $50 for low- and middle-income families.

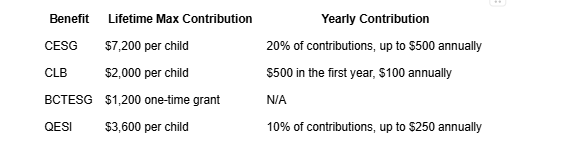

How Much Does the Government Contribute to an RESP?

Here’s a quick breakdown of government contributions to an RESP:

Types of RESP Withdrawals

RESP funds come from three sources: your contributions, government benefits, and investment earnings. Consequently, there are three types of RESP withdrawals:

1. Educational Assistance Payments (EAP):

- EAPs are the funds from government grants and accumulated earnings. These are taxable in the hands of the student.

2.Accumulated Income Payments (AIP):

- AIPs consist of unused RESP earnings, paid to you if the funds aren’t used for education. These are taxable at your regular income tax rate plus an additional 20%.

3.Contribution Withdrawals:

- As a subscriber, you can withdraw your contributions tax-free at any time, subject to the terms of your RESP plan.

RESP Withdrawal Rules

Before withdrawing funds from an RESP, here are some essential rules to keep in mind:

- Eligible Post-Secondary Institutions: Ensure the beneficiary is enrolled in an eligible institution (universities, colleges, or other designated educational institutions in Canada or abroad).

- Proof of Enrollment: You must provide official proof of enrollment to your RESP promoter, who may also require receipts for school-related purchases.

- EAP Limits:

- For full-time programs, the EAP withdrawal limit is $8,000 for the first 13 weeks.

- For part-time programs, the limit is $4,000 per 13-week period.

What Happens If RESP Funds Go Unused?

If the beneficiary doesn’t pursue post-secondary education, here are your options:

- Keep the RESP open in case they decide to attend school later.

- Replace the beneficiary with another eligible person.

- Transfer the funds to another RESP or a registered retirement savings plan (RRSP).

- Close the RESP and withdraw the contributions (government grants will be returned to the government).

Are RESP Contributions Tax-Deductible?

No, RESP contributions are not tax-deductible. However, interest earned on your contributions remains tax-free as long as it stays in the RESP. Additionally, EAPs are taxed in the hands of the student, who usually has little to no taxable income during their studies.

If the RESP isn’t used for education, AIPs are taxed at the subscriber’s income tax rate plus 20%.

Over-Contributions and Penalties

It’s essential to note that the lifetime RESP contribution limit is $50,000 per beneficiary. If you exceed this limit, you’ll face a 1% tax penalty on the excess amount for each month it remains in the RESP.

By understanding the rules and benefits of RESP withdrawals, you can make the most of your savings and ensure your child’s educational journey is financially supported!

Key Takeaways

- Anyone—parent, guardian, grandparent, other relatives, or friends—can open an RESP for a child. Adults can even open an RESP for themselves.

- The government provides benefits such as the Canada Education Savings Grant (CESG), Canada Learning Bond (CLB), and provincial incentives in British Columbia and Québec.

- No contributions are required to access the Canada Learning Bond (CLB).

Bring your books up to date

CONTACT US TODAY

Contact Number